These materials must also meet other energy star requirements and it is best to check these requirements when choosing materials.

Qualified roof coating for irs energy credits.

The home must also be located in the united states.

Use these revised instructions with the 2018 form 5695 rev.

Prior to january 1 2020.

Learn more and find products.

Tax credits for non business energy property are now available for products installed on the taxpayer s primary residence in the u s.

10 of cost note.

These instructions like the 2018 form 5695 rev.

In 2018 and 2019 an individual may claim a credit for 1 10 percent of the cost of qualified energy efficiency improvements and 2 the amount of the residential energy property expenditures paid or incurred by the taxpayer during the taxable year subject to the overall credit limit of 500.

To qualify for the credit the qualified roofing product must have been purchased and placed into service during the applicable tax year on an existing home not new construction which was your primary residence and which you owned.

The two main types of eligible roofing materials are metal roofs with pigmented coating and asphalt roofs with cooling granules.

The list that follows is our attempt to create a comprehensive list of shingles that appear to qualify for the maximum 1500 2010 energy tax credit.

Metal roofs with pigmented coatings and asphalt roofs with cooling granules will qualify for this.

For example energy efficient exterior windows and doors certain roofs and added insulation all qualify but costs associated with the installation weren t included.

February 2020 have been revised to reflect the extension of the nonbusiness energy property credit to 2018 by the taxpayer certainty and disaster tax relief act of 2019.

Roofs this tax credit has expired this tax credit is for energy star certified metal and asphalt roofs with pigmented coatings or cooling granules designed to reduce heat gain.

You may claim a tax credit of 10 of cost of the.

There is a total combined credit limit of 500 for all purchases improvements for all years since 2005.

We generated this list by looking at energystar qualified shingles whose manufacturers provide a manufacturers certification statement claiming that their shingles qualify.

The first part of this credit was worth 10 of the cost of qualified energy saving equipment or items added to a taxpayer s main home in the past year.

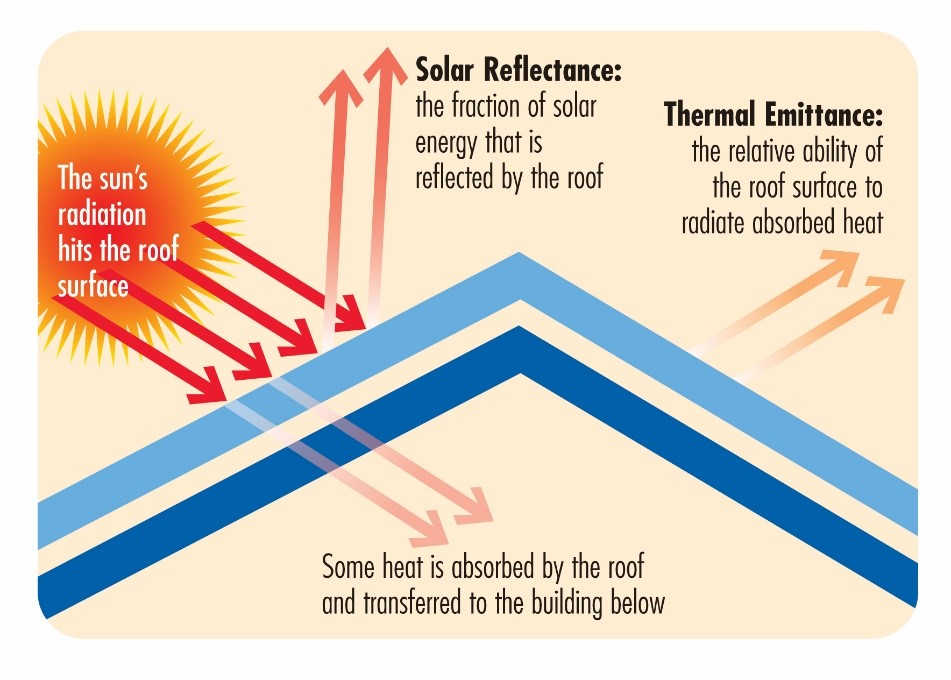

Asphalt and metal roofs if your roof meets energy star standards your roof will reflect more of the sun and reduce surface temperatures by up to 100 f.

Only certain roofing materials qualify for tax credits.